What is Scalping in Forex?

Scalping is a trading strategy in the forex market that aims to exploit small price movements, typically through the execution of numerous trades within short periods. The primary objective of a scalper is to capitalize on minor fluctuations in currency prices, which can accumulate substantial profits over time. Typically, trades in scalping are held for a few seconds to a few minutes, with traders closing positions quickly to secure small gains.

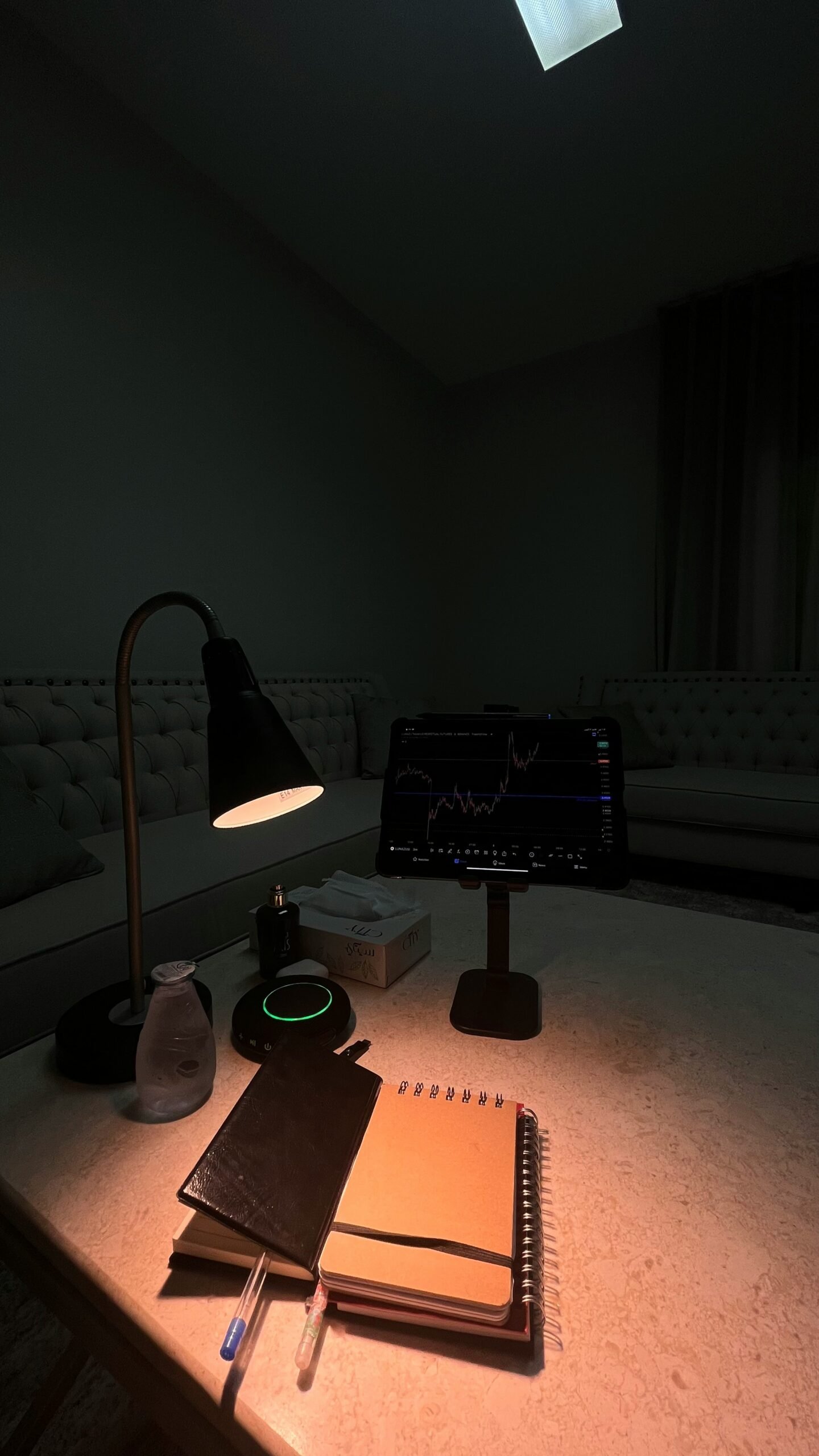

Scalping strategies often involve using high-frequency trading techniques, where traders rely heavily on technical analysis and price action. Scalpers typically utilize short timeframes, such as one-minute, five-minute, or even tick charts, to identify entry and exit points. By making quick trades, scalpers can take advantage of a volatile market, but this requires a sound understanding of market dynamics and timing.

The skills and mindset required for scalping are distinctive. A successful scalper must possess a keen ability to analyze rapid market data and maintain significant focus and discipline under pressure. Effective risk management is also crucial, as even a slight miscalculation can lead to substantial losses in this fast-paced environment. Another key characteristic of scalpers is their need for a robust trading plan, often backed by specific indicators and strategies to guide their decisions.

While scalping offers the potential for quick profits, it is not without its risks. The primary risk associated with scalping lies in the high transaction costs due to the frequency of trades, which can erode the profits. Moreover, the psychological strain of consistently monitoring the market can be demanding, making it essential for scalpers to cultivate a strong emotional fortitude. Overall, scalping can be a lucrative trading style for those equipped with the right skills and temperament to navigate its challenges.

What is Day Trading in Forex?

Day trading in the Forex market refers to the practice of buying and selling currency pairs within a single trading day, with the aim of closing all positions before the market closes. This trading style is designed to capitalize on short-term price movements and to avoid overnight risks that can arise due to unexpected news or events that may impact currency values. Day traders utilize various technical analysis techniques, employing tools such as price charts, indicators, and trend analysis to make informed trading decisions.

The primary features of day trading include a focus on small price changes and holding positions for a few minutes to hours, rather than days or weeks. Day traders typically conduct multiple trades in a single session, seeking to capitalize on short-lived market opportunities. Common strategies employed by day traders include scalping, trend following, and range trading, which allow them to navigate the volatile nature of the Forex market effectively.

One of the main goals of day traders is to achieve consistent profitability by accumulating small gains that, over time, can lead to significant overall returns. This requires a disciplined approach, as traders must quickly assess market conditions and make rapid decisions in response to price changes. The advantages of day trading include the potential for high returns and the opportunity to gain exposure to the Forex market without leveraging overnight risks. However, challenges also exist, including the need for significant time commitment, emotional resilience, and an ability to adapt to changing market conditions.

Success in day trading demands rigorous analytical skills and strict discipline in executing trades, along with a comprehensive understanding of market dynamics. This unique trading style can be highly rewarding for those who invest the time and effort to master it, while also carrying inherent risks associated with fast-paced trading environments.

Key Differences Between Scalping and Day Trading

Scalping and day trading are two prevalent trading strategies within the Forex market, each characterized by distinct methodologies and timeframes. One of the most salient differences between the two lies in trade duration. Scalping focuses on short-term trades, with positions typically held for seconds to minutes, aiming to capture small price movements. Conversely, day trading involves holding positions throughout a single trading day, often for minutes to several hours, but not overnight. This fundamental divergence significantly affects a trader’s approach and strategy.

Another key aspect is the frequency of trades. Scalpers execute a high volume of trades throughout the day, sometimes numbering in the hundreds, while day traders engage in fewer trades, generally ranging from a handful to several dozen. This higher trade frequency in scalping demands quick decision-making and execution, requiring traders to maintain extreme focus and discipline during market hours.

Risk management represents a critical component of both strategies, albeit implemented differently. Scalpers typically employ strict stop-loss orders to limit potential losses from rapidly fluctuating prices. They often target a risk-to-reward ratio that tilts heavily in their favor due to the high frequency of trades. On the other hand, day traders tend to utilize a longer-term view on risk and may incorporate wider stop-loss parameters, acknowledging that their trades could take longer to realize potential profit.

Market analysis techniques further differentiate scalping and day trading. Scalpers often rely on technical analysis, utilizing short-term charts and indicators to make split-second decisions. In contrast, day traders might utilize a combination of technical and fundamental analysis, as they are more likely to be influenced by broader economic events impacting the overall market sentiment.

Lastly, the emotional and psychological aspects of trading are impactful in both styles. Scalpers require a heightened level of concentration and composure, as rapid trades can induce stress. Day traders, while also needing discipline, may experience different emotional dynamics due to their longer exposure to market fluctuations and potential overnight risks.

Choosing the Right Trading Style for You

In the world of Forex trading, selecting an appropriate trading style is crucial to achieving success and aligning with personal goals. Understanding your personality, lifestyle, and objectives is essential in determining whether scalping or day trading is the best fit for you. To begin, evaluate your skills and experience level in trading. Novice traders may benefit from starting with day trading, as it allows for more extensive analysis and decision-making time compared to the rapidity of scalping.

Risk tolerance is another key factor to consider. Scalping generally involves a higher frequency of trades, which inherently carries more risk due to the volatility of short-term price movements. If you have a lower risk tolerance, day trading may be more suitable, as it often allows the trader to implement strategies that accommodate slight variations in the market. Understanding how much capital you are willing to risk per trade can help you assess the best trading approach for your financial situation.

Time availability is perhaps the most practical consideration. Scalping demands significant time commitment and rapid decision-making, potentially requiring traders to monitor the markets continuously. On the other hand, day trading can offer more flexibility in terms of dedicated trading hours, allowing you the opportunity to engage in analysis without the pressure of instantaneous transactions. Therefore, assess your daily schedule and commitments to gauge which trading style you can realistically follow.

To make the best decision, consider experimenting with both scalping and day trading in a simulated trading environment. This hands-on experience can provide valuable insights into which approach resonates more with your natural inclinations and trading preferences. Remember, the Forex market is dynamic and ever-evolving; thus, continuous learning and adaptation are paramount. Embrace the journey, remain patient, and refine your style as you grow in your trading career.